Do-it-yourself bookkeeping is on the rise. The promise of easy-to-use bookkeeping and time-saving sounds great, but often ends up not fully coming to fruition. It becomes easy to miss some financial aspects since your expertise is law, not accounting or bookkeeping. This issue has become so prevalent that, up to 60% of complaints against attorneys concern, either directly or indirectly, books and records violations. The degree to which attorneys are punished varies, but in one case, “a solo practitioner was suspended for 18 months for a number of violations including the failure to safeguard client funds and maintain his law practice’s books and records as required by Rule 1.15. He also violated Rule 8.4 by misrepresented the status of books and records.”1

The reality is that your bookkeeping must be fully comprehensive, absolutely consistent, and expertly competent. There is too much at stake professionally and personally to fully trust your livelihood to a program or a bookkeeper who is part-time into bookkeeping and part-time into social media promotion.

Comprehensive

Your law firm books are either current or not current, thorough or incomplete, reconciled, or in a wreck. The great truism in accounting is that it is black or white. Partial completion of your books is at best misguided and at its worst, misleading. Incorporating all aspects of your firm from advance payments to trust account payments is necessary to have confidence that your books can withstand an audit.

Consistency

Consistent bookkeeping is the habit that creates up-to-date, current, and accurate books. The habitual practice of categorizing, inputting, reconciling, posting, and confirming is often the last “important” matter that receives our attention as business owners. Implementing the time to learn and master the concepts and then aggregate all of the necessary records often takes more time than we expect. Blocking more time from your schedule to then accurately update, maintain, and keep these records is often costly (in regard to your hourly cost) and just not practical.

Competency

The ability to do something well is generally regarded as a competency. You went to law school, so it is reasonably assumed that you have a great deal of competency in regard to the practice of law. The reality is that your competency doesn’t extend into the area of accounting and bookkeeping. One in three small businesses, including law firms, hire a qualified bookkeeper and only 23% of all small businesses hire an accountant. Competency is important because it takes no fewer than 40 credit hours of study to earn the opportunity to take the CPA exam.

The idea of competency goes both ways. Some people hire a CPA and that’s a great first step to get your firm on track.

It’s only the first step. If you have a CPA with no legal credentials, then you are only partially fulfilling the needs of your firm. You need to get on the fast track to success and growth.

The reality is that you need a CPA firm who has competency in the field of law. If not, you are only really getting a one-sided view of the bookkeeping and accounting that you need. You truly need a firm that has an intricate familiarity and understanding of the practice of law and how that pertains to certain records and bookkeeping. You need an accounting firm that is able to understand the many different practice management systems in use (Clio, PracticePanther, ActionStep, etc.). You need an accounting firm that is able to understand and operate different bookkeeping programs (QuickBooks, Xero, etc.).

Three Simple Questions You Should Be Asking

If you currently are working with a bookkeeping and accounting firm, ask the following questions to see if their competencies match your needs:

Are you competent in the use of Clio, PracticePanther, or ActionStep? To what degree have you used them?

Are you competent in the use of other bookkeeping software besides Quickbooks? If so, which

ones?

Are you competent in compiling Key Performance Indicators (KPIs) to show me how my firm can make changes to focus on growth?

Is There A Better Way?

If your current bookkeeper or accountant also seems to be a part-time social media influencer, then you may want to reconsider. You need a firm whose sole focus is analyzing your firm through the lens of law, bookkeeping, and accounting 100% of the time. In fact, firmTRAK is the only bookkeeping and accounting firm founded by lawyers and accountants. We are uniquely able to help put your firm on the fast track to success and growth.

We realize that you went to law school to become a lawyer, not to reconcile accounts and billing information. We work seamlessly with PracticePanther, Clio, Xero, Quickbooks, firmTRAK KPI Reporting, and ActionStep to automate your business services.

An Industry First

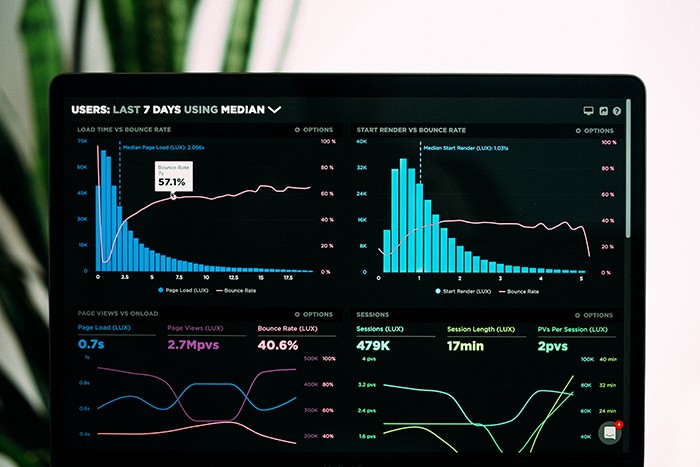

In addition to bookkeeping and accounting, firmTRAK provides an industry-first Key Performance Indicator cloud-based platform called firmTRAK Visualize. This gives you the ability to harness your practice management data to unlock the true potential of your law firm with instant, ready-made key performance indicator (KPI) reporting. This will allow your firm to base decisions on accurate, real-time business reporting and easily maximize your strengths and make corrections in areas that need improvement. You’ll be able to easily see your financial and practice trends with firmTRAK Visualize.

Maximize Your Time and Your Money

Instead of just looking at your firm through the lens of accounting and bookkeeping, we have a unique ability to analyze your needs through the additional lens of practicing attorneys. Using firmTRAK will allow you to completely transform your law firm’s finances and performance starting at $499 per month for small firms. firmTRAK is an automated accounting, bookkeeping, payroll, and reporting solution built to streamline your business and unlock your growth.

We’d love to prove our value to you with a quick 15 minute phone call. Please fill out our questionnaire here (hyperlink will be inserted here) and we will call you to set up a time. In this case 15 minutes could truly save you more than just money. We can help save your firm time, money, and get you back peace of mind and a focus on what you went to law school to do – help people.

Upcoming Series

Three way trust reconciliation – we know that you didn’t go to law school to become a banker or money manager, but the fact is that if you agree to hold money in trust, you take on a non-delegable, personal fiduciary responsibility to account for the funds as long as they remain in your possession. The legal and ethical obligation to account for those funds is yours alone, regardless of your lack of financial knowledge or how busy your practice is. Failure to live up to this duty can result in personal monetary liability, fee disputes, loss of clients, and public discipline.

Wouldn’t it be helpful to have a system to help take this off your hands with guaranteed compliance? firmTRAK is your solution to this state-mandated responsibility. Keep an eye out for our upcoming three-part series on trust reconciliation.

Source:

1“BOOKS AND RECORDS VIOLATIONS CONTINUE TO PLAGUE LAW FIRMS.” Books and Records Violations Continue to Plague Law Firms, 2016, virtualparalegalservices.com/blog-entries/books-and-records-violations-continue-to-plague-law-firms/.